- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

The rich have to pay their fair dues!

Talk about too little too late.

Millennials are already entering their 40’s and still struggle to buy property. Most of them have given up on having kids because of this. Gen Z might still have a chance but by the time the financial aid kicks in, they’ll be reaching their 40’s too.

And that’s if the conservatives don’t get elected. Which is apparently very likely since new survey data shows gen Z and alpha are leaning towards the conservative party.

Then again…

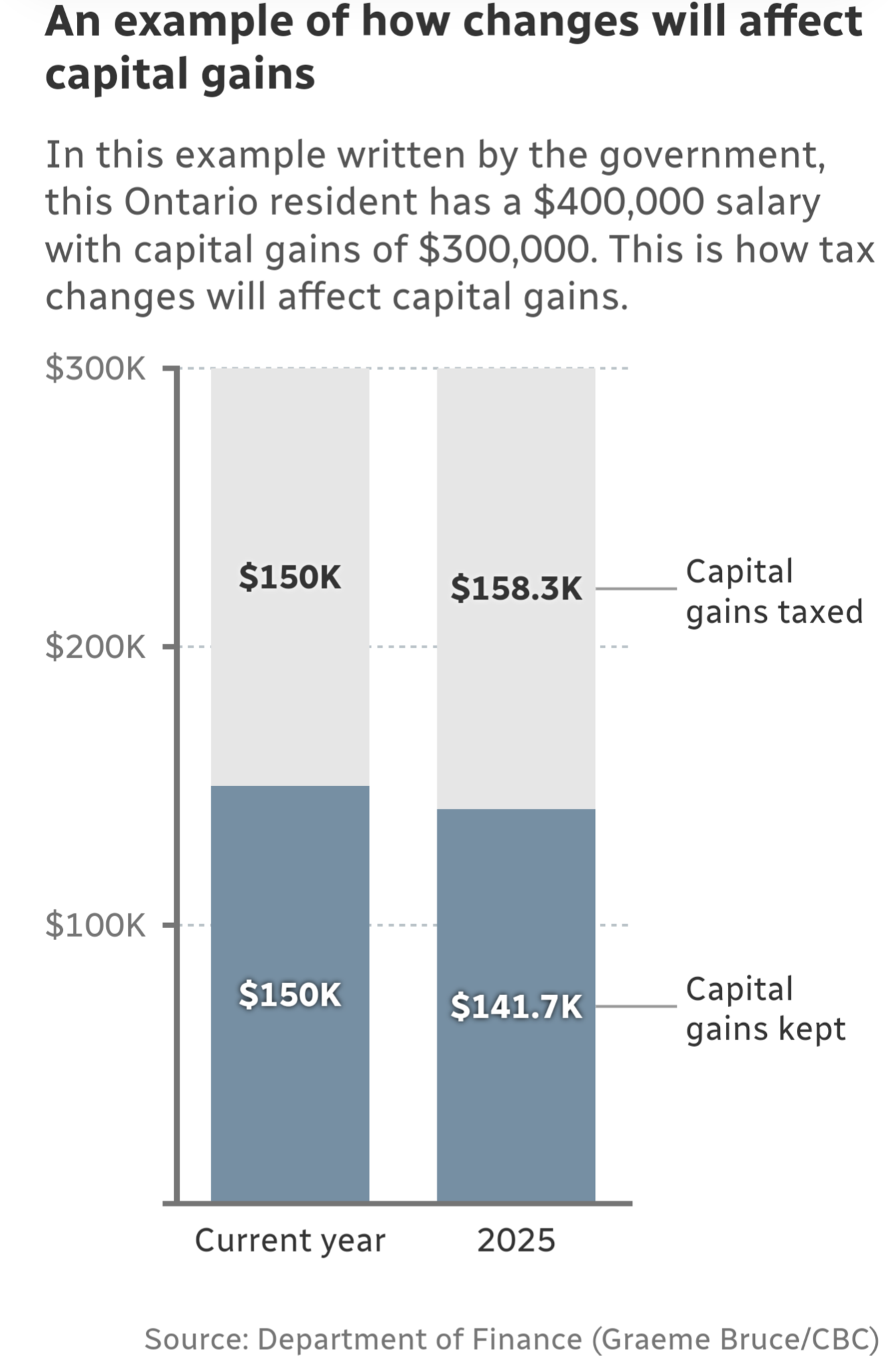

Oh my god, the rich are going to suffer immensely under this tax hike!

In starting to feel like 3/4 would have been better than 2/3.

I can’t even fathom the problems someone with a $400K salary has to deal with.

A four hundred thousand dollar salary and a three-hundred dollar capital gains windfall? So $700k of income in one year, right?

And, if I read this correctly, they’re either paying $9k more, or that $9k that’s being taxed more. Even if it’s the former, that’s 0.02% of their year income…

Oh, woe is me, how will they ever survive!?

I wonder how accurate this number will be.

Freeland will hike capital gain taxes paid by the rich and corporations to collect an estimated $19 billion in new revenue.

Lots of good ideas here. Proof will be in the pudding.

Anyone who proclaims that the housing crisis is purely a provincial or municipal matter should read this budget to expand their imagination.

This is the best summary I could come up with:

Finance Minister Chrystia Freeland’s fourth budget delivers a big-ticket housing program for millennials and Generation Z voters — a multi-billion dollar commitment to be paid for in part with a tax hike on the rich and corporate Canada.

The Liberal government’s preferred “fiscal anchor” — the budget benchmark that guides its decisions — has long been to keep the net debt-to-GDP ratio on a declining trend, with debt levels closely tracking the overall size of the economy.

The cost to finance Canada’s growing debt pile — which has more than doubled over the last nine years to $1.4 trillion — is eating up more and more taxpayer dollars as the government is forced to refinance its borrowing at higher rates.

Public debt charges will cost $2 billion more this year than the forecast in November as the Bank of Canada keeps rates relatively high to tame inflation — which has shown signs of slowing down.

The government also has committed to maintaining the already well-subscribed tax-free savings account, extending mortgage amortization terms and increasing the RRSP withdrawal limit for some first-home buyers, among other measures.

As Ottawa moves to remake the housing landscape, roll out a national dental care program and launch pharmacare, Freeland’s budget includes a number of targeted tax hikes that it says will yield some $21.9 billion in new revenue over the next five years.

The original article contains 1,279 words, the summary contains 228 words. Saved 82%. I’m a bot and I’m open source!